Imagine a world where every transaction you make is secure and transparent, where your savings are protected and easily accessible. Well, thanks to the potential of blockchain technology, that world is becoming a reality. In this article, we will explore how blockchain is revolutionizing customer transactions and savings, providing a level of security and transparency like never before.

Blockchain, often associated with cryptocurrencies like Bitcoin, is a decentralized digital ledger that records transactions across multiple computers. It’s like a digital spreadsheet that is constantly updated and verified by a network of computers, making it virtually impossible to alter or manipulate. This technology has the potential to transform the way we conduct financial transactions, ensuring they are secure, transparent, and tamper-proof.

With blockchain, customer transactions are protected by advanced encryption and cryptographic algorithms, making them highly secure. Unlike traditional banking systems that rely on a centralized authority, blockchain eliminates the need for intermediaries, reducing the risk of fraud and cyber attacks. Furthermore, every transaction recorded on the blockchain is transparent and can be viewed by anyone, providing an unprecedented level of trust and accountability.

When it comes to savings, blockchain offers exciting possibilities. Smart contracts, which are self-executing agreements written in code, can automate savings plans and eliminate the need for intermediaries. These contracts can be programmed to automatically allocate funds, invest in diverse portfolios, and even distribute dividends. With blockchain, your savings are not only secure, but they can also grow and generate passive income without the need for complex financial institutions.

In conclusion, the potential of blockchain for secure and transparent customer transactions and savings is immense. This technology is reshaping the financial landscape, providing individuals with more control over their money and fostering trust in the digital realm. As blockchain continues to evolve and gain mainstream adoption, we can expect even greater innovations in the way we transact and save. So, buckle up and get ready for a future where your financial interactions are safe, transparent, and empowering.

Blockchain technology has immense potential for revolutionizing customer transactions and savings. With its secure and transparent nature, blockchain ensures that transactions are tamper-proof and cannot be altered or manipulated. This level of security provides customers with peace of mind, knowing that their transactions are safe from fraud and unauthorized access. Additionally, blockchain’s transparency allows customers to verify and track their transactions, promoting trust and accountability. By leveraging blockchain, businesses can enhance customer experiences, streamline processes, and create a more secure and transparent financial ecosystem.

The Potential of Blockchain for Secure and Transparent Customer Transactions and Savings

Blockchain technology has revolutionized the way we perceive and conduct transactions. With its decentralized and transparent nature, it has the potential to provide secure and efficient solutions for customer transactions and savings. In this article, we will explore the various ways blockchain can be utilized to enhance security, transparency, and trust in financial transactions.

Enhancing Security in Customer Transactions

Blockchain technology offers a high level of security for customer transactions. Its decentralized nature eliminates the need for intermediaries and centralized databases, reducing the risk of data breaches and fraud. Each transaction is recorded in a block, which is linked to previous blocks through cryptographic algorithms, creating an immutable and tamper-proof ledger.

One of the key features of blockchain is its consensus mechanism, which ensures that all participants in the network agree on the validity of each transaction. This eliminates the need for trust in a centralized authority, as the integrity of the transaction is verified by multiple participants. Additionally, blockchain uses advanced encryption techniques to protect sensitive customer information, further enhancing the security of transactions.

With blockchain, customers can have more control over their personal data and financial information. They can choose to share specific data with authorized parties, reducing the risk of identity theft and unauthorized access. Moreover, blockchain can enable the use of smart contracts, which are self-executing agreements with predefined conditions. This eliminates the need for intermediaries and manual verification processes, streamlining transactions and reducing the potential for human error or malicious activities.

Reducing Fraud and Ensuring Transparency

Blockchain technology provides an unprecedented level of transparency in customer transactions. Each transaction is recorded on a public ledger, accessible to all participants in the network. This transparency creates a sense of trust and accountability among customers and businesses, as they can verify the authenticity of transactions and track the movement of funds.

The decentralized nature of blockchain eliminates the risk of a single point of failure, making it highly resistant to hacking and fraud. As each transaction is validated by multiple participants, any attempts to manipulate or alter the data would require the consensus of the majority of the network. This makes fraudulent activities extremely difficult and increases the overall security of customer transactions.

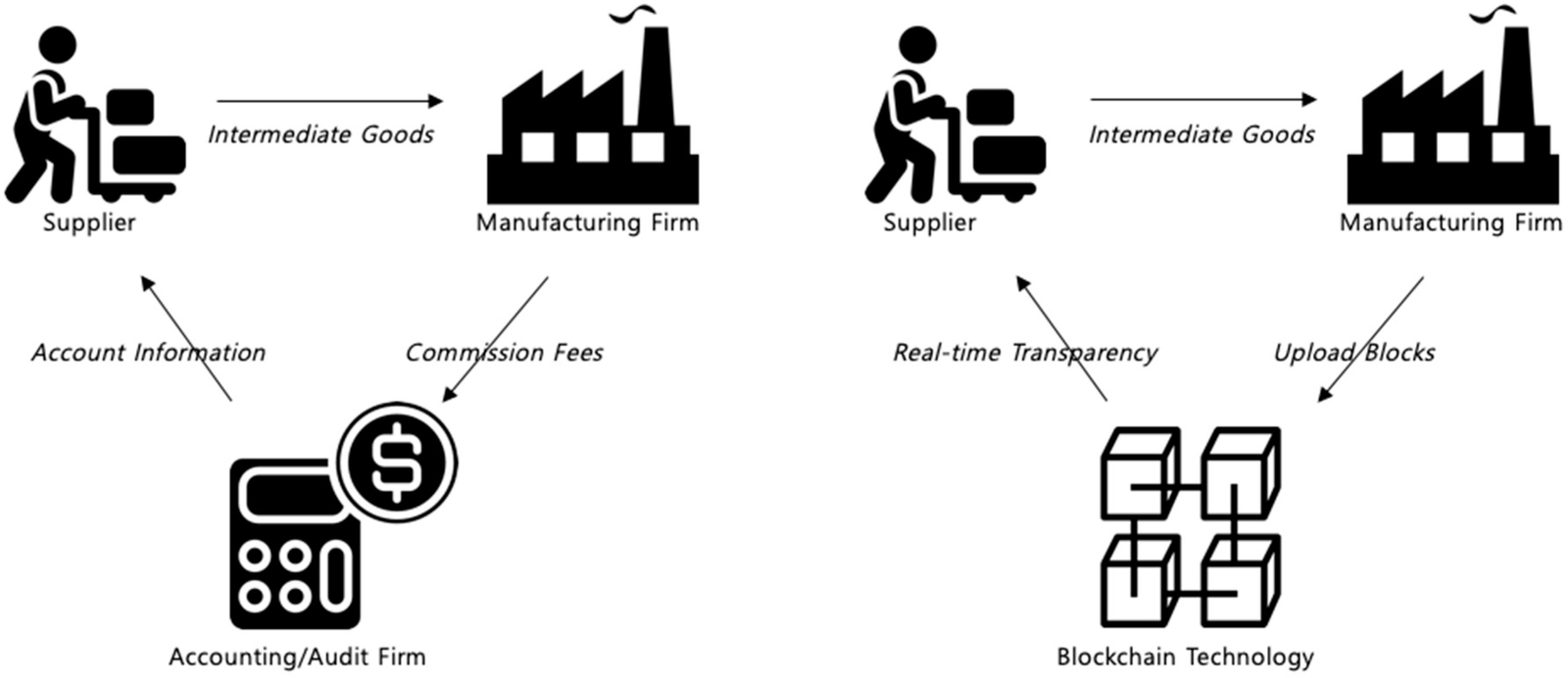

Moreover, blockchain can facilitate the auditing process for businesses and regulatory authorities. The transparent and immutable nature of the ledger allows for real-time and accurate auditing, reducing the time and resources required for traditional auditing methods. This ensures compliance with regulations and enhances the overall integrity of financial transactions.

In addition to security and transparency, blockchain technology can also bring significant cost savings for both customers and businesses. By eliminating the need for intermediaries, such as banks or payment processors, blockchain reduces transaction fees and processing times. This can result in more affordable and efficient financial services for customers, as well as cost savings for businesses.

By leveraging blockchain technology, financial institutions can streamline their processes, reduce operational costs, and enhance the overall customer experience. Customers can benefit from faster and more secure transactions, lower fees, and increased control over their financial information. As blockchain continues to evolve and gain mainstream adoption, its potential for secure and transparent customer transactions and savings will only continue to grow.

The Potential of Blockchain for Secure and Transparent Customer Transactions and Savings

- Blockchain technology provides a secure and transparent way for customers to conduct transactions and manage their savings.

- By using cryptography and decentralized networks, blockchain ensures that customer data is protected from unauthorized access.

- With blockchain, transactions are recorded on a public ledger, allowing customers to verify the accuracy and integrity of their transactions.

- Blockchain eliminates the need for intermediaries, reducing costs and increasing efficiency in customer transactions and savings.

- By leveraging smart contracts, blockchain enables automated and trustless transactions, providing convenience and reliability for customers.

Frequently Asked Questions

What is blockchain technology and how does it ensure secure and transparent customer transactions?

Blockchain technology is a decentralized digital ledger that records transactions across multiple computers, creating a transparent and secure system. When a transaction occurs, it is verified by a network of computers known as nodes, and once verified, it is added to a block of transactions. This block is then linked to the previous block, creating a chain of information that is almost impossible to alter or tamper with.

The security of blockchain lies in its distributed nature. Since the ledger is maintained by multiple nodes, there is no central authority that can manipulate or control the data. Each transaction is encrypted and connected to the previous transaction, creating a permanent and immutable record. This ensures that customer transactions are secure and transparent, as they can be easily traced and verified by anyone with access to the blockchain.

What are the benefits of using blockchain for customer transactions and savings?

Using blockchain for customer transactions and savings brings several benefits. Firstly, it enhances security by eliminating the need for intermediaries or third parties. Transactions are verified and recorded directly on the blockchain, reducing the risk of fraud or manipulation. This increases trust and confidence among customers, knowing that their transactions are secure and transparent.

Secondly, blockchain offers faster and more efficient transactions. Traditional banking systems often involve lengthy processes and delays, especially for cross-border transactions. With blockchain, transactions can be processed in near real-time, reducing the time and cost associated with traditional banking systems.

Another benefit is the potential for cost savings. By eliminating intermediaries, blockchain reduces transaction fees and other costs associated with traditional banking systems. This can result in significant savings for both customers and businesses, making financial services more accessible and affordable.

Can blockchain technology be applied to different industries apart from finance?

Absolutely! While blockchain is commonly associated with finance and cryptocurrencies, its potential goes beyond these industries. Blockchain technology can be applied to various sectors such as supply chain management, healthcare, voting systems, and more.

In supply chain management, blockchain can provide transparency and traceability, ensuring the authenticity and origin of products. In healthcare, it can securely store and share patient records, enabling better coordination and privacy. In voting systems, blockchain can enhance the integrity and transparency of elections, reducing the risk of fraud.

The decentralized and transparent nature of blockchain makes it applicable to any industry that requires secure and tamper-proof transactions or data storage.

Are there any challenges or limitations to implementing blockchain for customer transactions and savings?

While blockchain technology holds immense potential, there are challenges and limitations to consider. One challenge is scalability. As more transactions are added to the blockchain, the network can become slower and less efficient. This is a problem that needs to be addressed to ensure widespread adoption and usability.

Another challenge is regulatory compliance. Blockchain operates on a global scale, and different jurisdictions have different regulations and requirements. Harmonizing these regulations can be complex and time-consuming.

Additionally, blockchain technology requires a certain level of technical expertise to implement and maintain. It may not be easily accessible to individuals or businesses without the necessary resources or knowledge.

What is the future outlook for blockchain technology in customer transactions and savings?

The future of blockchain technology in customer transactions and savings looks promising. As more businesses and industries recognize the potential of blockchain, we can expect to see increased adoption and integration into existing systems.

Blockchain has the potential to revolutionize financial services by providing secure, transparent, and efficient transactions. It can enable peer-to-peer transactions without the need for intermediaries, reducing costs and increasing accessibility.

Furthermore, advancements in blockchain technology, such as the development of scalable solutions and improved regulatory frameworks, will pave the way for wider adoption. As blockchain continues to evolve and mature, it has the potential to transform how we conduct transactions and manage savings, ultimately benefiting customers and businesses alike.

Final Summary: The Exciting Future of Blockchain Technology

As we come to the end of our exploration into the potential of blockchain for secure and transparent customer transactions and savings, it’s clear that this revolutionary technology holds immense promise. By leveraging the power of decentralized systems, blockchain has the ability to transform the way we conduct financial transactions and manage our savings. Its secure nature, transparency, and ability to eliminate intermediaries make it a game-changer in the world of finance.

Blockchain’s potential goes far beyond just cryptocurrencies like Bitcoin. With its decentralized ledger and smart contract capabilities, it can streamline and secure various customer transactions, ranging from supply chain management to real estate transactions. This technology has the potential to make processes more efficient, reduce costs, and increase trust among participants.

Furthermore, blockchain technology has the ability to empower individuals by giving them control over their own financial data and transactions. With blockchain, customers can have a transparent view of their financial history, ensuring that their savings are secure and tamper-proof. This level of transparency can also help in preventing fraudulent activities and ensuring compliance with regulations.

In conclusion, the future looks incredibly promising for blockchain technology. Its potential to revolutionize secure and transparent customer transactions and savings is undeniable. As this technology continues to evolve and gain wider adoption, we can expect to see more innovative use cases and transformative applications in various industries. So, buckle up and get ready for a world where blockchain takes center stage in the financial landscape. Exciting times lie ahead!