Are you tired of spending countless hours on financial reporting? Well, look no further! In this article, we will delve into the world of Robotic Process Automation (RPA) and how it can revolutionize your financial reporting process. With its advanced technology and automated capabilities, RPA is the key to streamlining your financial reporting tasks and boosting efficiency. So, sit back, relax, and let’s explore the exciting world of Robotic Process Automation for streamlined financial reporting.

When it comes to financial reporting, accuracy, speed, and efficiency are paramount. Traditional manual methods are not only time-consuming but also prone to human errors. But fear not! Robotic Process Automation is here to save the day. By leveraging cutting-edge technology, RPA allows for the automation of repetitive and rule-based tasks in financial reporting, freeing up valuable time for finance professionals to focus on more strategic initiatives. From data extraction and validation to report generation and analysis, RPA can handle it all with precision and speed.

With its ability to interact with various systems and applications, RPA eliminates the need for manual data entry and reduces the risk of errors. This means you can say goodbye to tedious spreadsheet manipulations and hello to accurate and reliable financial reports. Whether you’re a small business or a multinational corporation, Robotic Process Automation can be customized to fit your specific needs, ensuring seamless integration into your existing financial processes. So, why waste time and resources on manual tasks when you can embrace the power of automation with RPA? Get ready to transform your financial reporting and take your business to new heights with Robotic Process Automation.

Robotic Process Automation for Streamlined Financial Reporting

Robotic Process Automation (RPA) has revolutionized various industries, including finance. With its ability to automate repetitive tasks, RPA has become an invaluable tool for streamlining financial reporting processes. By leveraging software robots, organizations can achieve greater efficiency, accuracy, and cost savings in their financial reporting activities.

The Role of RPA in Financial Reporting

RPA plays a crucial role in financial reporting by automating manual and time-consuming tasks. These tasks include data collection, data entry, data reconciliation, and report generation. By automating these processes, RPA eliminates the risk of human error, reduces the time required for completion, and ensures data integrity.

One of the key benefits of RPA in financial reporting is its ability to perform complex calculations and analysis. Software robots can access and process large volumes of data from multiple sources, perform calculations, and generate reports with speed and accuracy. This not only saves time but also enables organizations to make data-driven decisions based on real-time information.

Benefits of RPA in Financial Reporting

Implementing RPA in financial reporting offers several benefits for organizations:

1. Improved Efficiency: RPA eliminates manual and repetitive tasks, allowing finance teams to focus on more strategic activities. This leads to improved productivity and faster turnaround times for financial reports.

2. Enhanced Accuracy: By removing the risk of human error, RPA ensures data accuracy and integrity in financial reports. This reduces the need for manual data validation and reconciliation, resulting in more reliable and trustworthy reports.

3. Cost Savings: RPA reduces the need for manual labor, resulting in significant cost savings for organizations. By automating financial reporting processes, companies can allocate their resources more efficiently and achieve higher ROI.

4. Scalability: RPA enables organizations to handle large volumes of data and scale their financial reporting processes as their business grows. Software robots can process data from various systems and generate reports in a fraction of the time it would take for manual processing.

5. Compliance and Auditability: RPA provides a transparent and auditable trail of activities, ensuring compliance with regulatory requirements. With RPA, organizations can easily track and monitor financial reporting processes, making it easier to meet compliance standards.

Implementing RPA in Financial Reporting

To successfully implement RPA in financial reporting, organizations need to follow a systematic approach. Here are some key steps to consider:

1. Identify Processes: Identify the financial reporting processes that are suitable for automation. These can include data collection, data entry, reconciliation, report generation, and analysis.

2. Evaluate Tools: Evaluate RPA tools and select the one that best fits your organization’s needs. Consider factors such as ease of use, scalability, integration capabilities, and cost.

3. Design Automation: Work with your finance and IT teams to design the automation workflow. Define the inputs, outputs, and rules for each process to be automated. Test the automation workflow thoroughly to ensure accuracy and efficiency.

4. Implement and Monitor: Implement the automation workflow in a controlled environment and closely monitor its performance. Make any necessary adjustments to optimize the automation process and ensure it meets the desired outcomes.

5. Train and Engage Employees: Train your finance team on how to work with RPA and leverage its capabilities. Emphasize the benefits of RPA in improving their productivity and job satisfaction. Encourage employees to provide feedback and suggestions for further process improvements.

6. Continuous Improvement: Regularly review and optimize the automated processes to identify areas for improvement. Leverage analytics and reporting capabilities of RPA tools to gain insights and make data-driven decisions.

By following these steps, organizations can effectively leverage RPA to streamline their financial reporting processes and achieve greater efficiency and accuracy.

Challenges and Considerations

While RPA offers significant benefits for financial reporting, there are also challenges and considerations that organizations need to be aware of:

1. Data Security: As RPA involves handling sensitive financial data, organizations need to ensure proper security measures are in place. This includes data encryption, access controls, and regular security audits.

2. Change Management: Introducing RPA in financial reporting requires change management efforts to address employee concerns and resistance. Proactive communication, training, and engagement are essential to ensure a smooth transition.

3. Scalability and Flexibility: Organizations need to consider the scalability and flexibility of their RPA solution. As business requirements evolve, the RPA implementation should be able to adapt and accommodate changing needs.

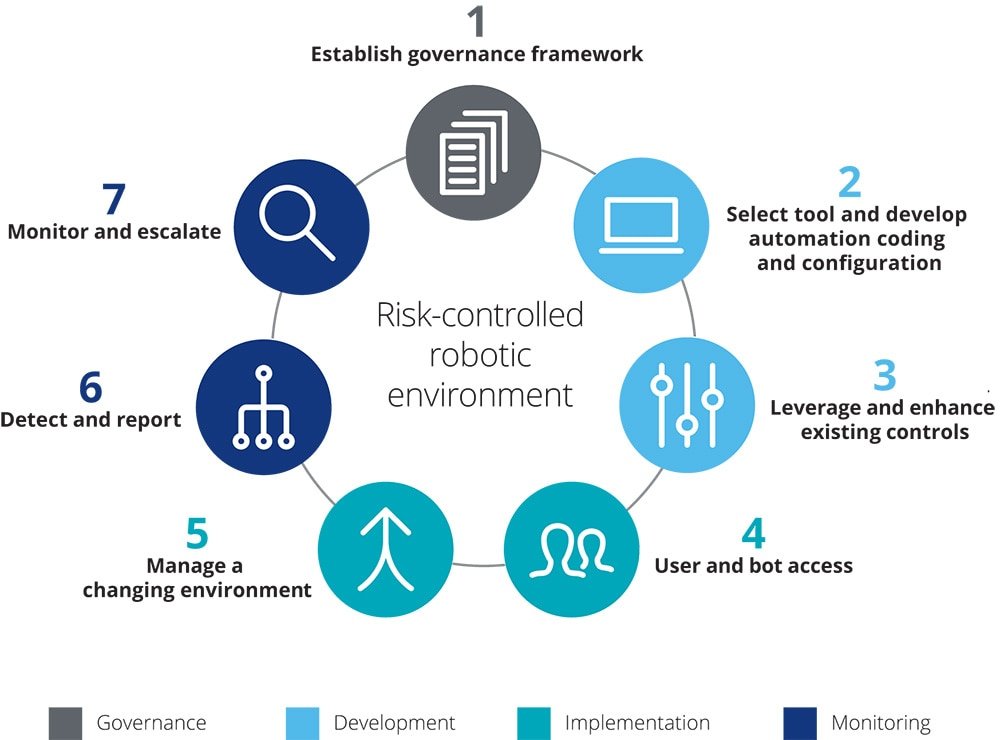

4. Governance and Compliance: Establishing proper governance and compliance frameworks is crucial when implementing RPA in financial reporting. This includes defining roles and responsibilities, ensuring data privacy, and complying with regulatory requirements.

5. Continuous Monitoring: Regular monitoring and performance evaluation of the RPA implementation are essential to identify and address any issues or inefficiencies. Organizations should have mechanisms in place to track and measure the effectiveness of RPA in financial reporting.

In conclusion, RPA offers significant benefits for streamlining financial reporting processes. By automating manual tasks, organizations can achieve greater efficiency, accuracy, and cost savings. However, it is essential to carefully plan and implement RPA, considering the unique challenges and considerations in the financial reporting context. With proper governance, training, and continuous improvement, organizations can harness the power of RPA to optimize their financial reporting activities.

Key Takeaways: Robotic Process Automation for Streamlined Financial Reporting

- Robotic Process Automation (RPA) can automate repetitive tasks in financial reporting, saving time and reducing errors.

- RPA robots can extract data from multiple sources and consolidate it into a single report, improving efficiency.

- Automated workflows in RPA can ensure compliance with regulations and reduce the risk of non-compliance.

- RPA can generate real-time reports, allowing for faster decision-making and improved financial analysis.

- Implementing RPA requires careful planning and collaboration between finance and IT teams.

Frequently Asked Questions

What is robotic process automation (RPA) for financial reporting?

Robotic process automation (RPA) for financial reporting is a technology that uses software robots or artificial intelligence to automate repetitive tasks and processes involved in financial reporting. These robots can perform tasks such as data entry, data reconciliation, report generation, and data analysis, allowing finance teams to streamline their reporting processes and improve efficiency.

By automating these tasks, RPA reduces the risk of errors and enhances the accuracy of financial reports. It also frees up finance professionals’ time, enabling them to focus on more strategic and value-added activities. RPA can be implemented across various financial reporting functions, including budgeting, forecasting, consolidation, and regulatory reporting.

How does robotic process automation improve financial reporting?

Robotic process automation (RPA) improves financial reporting by automating manual and repetitive tasks, reducing the risk of human errors, and speeding up the reporting process. RPA software robots can extract data from multiple sources, validate and reconcile the data, and generate accurate and consistent reports.

RPA also improves data accuracy by eliminating the need for manual data entry and reducing the risk of data entry errors. The software robots can perform complex calculations, analyze large volumes of data, and identify anomalies or trends in financial data, providing valuable insights for decision-making.

What are the benefits of implementing robotic process automation in financial reporting?

Implementing robotic process automation (RPA) in financial reporting offers several benefits. First and foremost, it improves efficiency by automating time-consuming tasks, allowing finance teams to complete reporting processes quickly and accurately. This frees up valuable time for finance professionals to focus on strategic activities that drive business growth.

RPA also enhances data accuracy and consistency by eliminating manual data entry and reducing the risk of errors. The software robots ensure that financial reports are generated with accurate and up-to-date data, improving the reliability of financial information.

Furthermore, RPA enables better compliance with regulatory requirements by automating data validation and reconciliation, ensuring that financial reports meet the necessary standards and guidelines. It also provides a higher level of transparency and auditability, as all actions performed by the software robots are logged and can be easily traced.

Is robotic process automation for financial reporting suitable for all organizations?

Robotic process automation (RPA) for financial reporting can benefit organizations of all sizes and industries. However, the suitability of RPA implementation may vary depending on factors such as the complexity of financial reporting processes, the volume of data, and the organization’s readiness for digital transformation.

Organizations with manual and repetitive financial reporting tasks can benefit greatly from RPA, as it can streamline processes, improve accuracy, and free up resources. Industries with strict regulatory requirements, such as banking and finance, can also benefit from RPA’s ability to ensure compliance and provide auditability.

Before implementing RPA, it is important for organizations to assess their existing processes and identify areas where automation can bring the most value. They should also consider factors such as the cost of implementation, potential resistance to change, and the need for proper training and support for employees.

What are the key considerations for implementing robotic process automation in financial reporting?

When implementing robotic process automation (RPA) in financial reporting, there are several key considerations to keep in mind. First, organizations should thoroughly assess their existing processes and identify tasks that are suitable for automation. This will help determine the potential benefits and return on investment.

It is also important to involve stakeholders from different departments, including finance, IT, and compliance, to ensure a smooth implementation. Communication and collaboration between these stakeholders are crucial for successful RPA implementation.

Organizations should also consider the scalability of RPA solutions, as financial reporting requirements may change over time. Choosing a flexible and scalable RPA platform will enable organizations to adapt to evolving needs and expand automation capabilities as necessary.

Lastly, proper training and support for employees are essential for successful RPA implementation. Employees should be involved in the process and provided with the necessary training to understand and work with the new technology. Ongoing support and monitoring are also important to address any challenges or issues that may arise during the implementation process.

Final Summary: Streamlined Financial Reporting with Robotic Process Automation

In today’s fast-paced business world, efficient financial reporting is crucial for organizations to make informed decisions and stay ahead of the competition. Robotic Process Automation (RPA) has emerged as a game-changer in streamlining financial reporting processes, saving time, reducing errors, and improving overall accuracy. By automating repetitive tasks, RPA allows finance teams to focus on value-added activities, such as data analysis and strategic decision-making.

With RPA, companies can automate various financial reporting tasks, including data extraction, data validation, data reconciliation, and report generation. This technology uses software robots to mimic human actions and interact with different systems, applications, and databases, enabling seamless integration and data exchange. By leveraging RPA in financial reporting, organizations can achieve faster and more accurate results, leading to enhanced efficiency, cost savings, and improved decision-making.

Implementing RPA for financial reporting not only streamlines processes but also ensures compliance with regulatory requirements. The software robots can perform tasks with precision, adhering to predefined rules and regulations. This eliminates the risk of human error and ensures data integrity, providing stakeholders with reliable and transparent financial reports. Moreover, RPA offers scalability, allowing businesses to handle increasing volumes of financial data without compromising accuracy or speed.

In conclusion, Robotic Process Automation is revolutionizing financial reporting by automating repetitive tasks, improving accuracy, and enhancing efficiency. By adopting RPA, organizations can streamline their financial processes, save time and costs, and empower their finance teams to focus on strategic initiatives. As technology continues to advance, RPA will play an increasingly vital role in driving streamlined financial reporting and enabling organizations to make data-driven decisions with confidence. Embrace the power of RPA and unlock the full potential of your financial reporting capabilities.