How to Optimize your Finance Department

- michael

- May 10, 2023

The finance department is the lifeblood of any organization, as it oversees and manages the flow of funds and financial activities. In an increasingly competitive business landscape, it is crucial to optimize the finance department to ensure its effective functioning and tomaximize the organization’s financial performance. This comprehensive guide will outline key strategies to optimize your finance department, focusing on improving efficiency, streamlining processes, and reducing costs.

1. Implement Robust Financial Management Software

Investing in a comprehensive financial management software solution is essential for optimizing your finance department. Look for software that offers automation, integration,

and analytics capabilities to streamline financial processes, reduce manual work, and improve overall efficiency. Additionally, integrating it with other systems within the organization will facilitate better collaboration and communication among departments, leading to better decision-making and resource allocation.

2. Embrace Automation

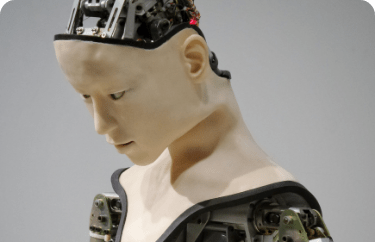

Automation is a powerful tool that can significantly improve the efficiency of your finance department. By automating repetitive tasks such as data entry, invoice processing, and report generation, your team can focus on more strategic initiatives and reduce the risk of human error. Automation tools like robotic process automation (RPA) and artificial intelligence (AI) can help to streamline operations, allowing your finance department to operate more effectively and contribute to the organization’s growth.

3. Encourage cross-functional collaboration

Foster collaboration between the finance department and other departments in the organization, such as sales, marketing, and operations. This will facilitate better decisionmaking and improve overall business performance. Regular cross-functional meetings, shared dashboards, and integrated data systems can help break down silos and encourage collaborative problem-solving. Encourage open communication and create a culture of

collaboration to ensure that the finance department is aligned with the organization’s objectives

4. Invest in Employee Training and Development

Continuous professional development is essential for finance department employees to stay current with industry best practices, regulations, and new technologies. Offer regular training and development opportunities, such as workshops, seminars, and e-learning programs. This investment will empower your team with the necessary skills and knowledge to operate efficiently and effectively. Additionally, providing opportunities for career growth and advancement will help to retain top talent and maintain a motivated workforce.

5. Prioritize Data-driven Decision-making

Utilize the wealth of financial data available to your organization to make informed decisions. Data analytics tools can help the finance department to identify trends, uncover insights, and make better forecasts. By leveraging data-driven insights, your finance team can contribute more effectively to strategic planning and decision-making. Promote a culture of data literacy within the finance department to ensure that employees understand the importance of data-driven decision-making and can effectively analyze and interpret financial data.

6. Optimize Financial Processes

Regularly review and assess the finance department’s processes and workflows to identify areas for improvement. This may include consolidating tasks, streamlining approvals, and standardizing documentation. Implementing lean methodologies and process improvement techniques, such as Six Sigma and Kaizen, can help to reduce waste and optimizeefficiency. Engage employees in the process improvement efforts to ensure buy-in and to promote a culture of continuous improvement.

7. Establish performance metrics and KPIs

Develop a set of key performance indicators (KPIs) that are specific, measurable, and relevant to the finance department’s goals. Regularly track and monitor these KPIs to identify trends, evaluate performance, and guide continuous improvement efforts. Implementing a performance management system can help to facilitate this process and maintain accountability. Make sure to communicate the importance of these KPIs to the finance department and ensure that all employees understand their role in achieving them.

8. Leverage technology for better financial analysis and reporting

In today’s fast-paced business environment, having access to accurate and timely financial information is crucial. Leverage advanced technology solutions, such as business intelligence (BI) tools and data visualization software, to improve financial analysis and reporting. These tools enable the finance department to generate real-time, accurate, and visually appealing reports, which can help the organization make informed decisions quickly and efficiently. In addition, implementing a centralized data repository can ensure data consistency and accuracy throughout the organization.

9. Implement strong internal controls

Strong internal controls are essential for reducing the risk of fraud and errors within the finance department. Establish clear policies and procedures for financial transactions, approvals, and record-keeping. Conduct regular audits and reviews to ensure compliance with these policies and to identify any potential weaknesses in the control environment. Investing in a robust internal control system not only helps to minimize financial risks but also enhances the reputation and credibility of the finance department.

10. Foster a culture of innovation and adaptability

As the business landscape continues to evolve, it is crucial for the finance department to stay ahead of the curve. Encourage a culture of innovation and adaptability within the department, promoting the continuous exploration of new tools, technologies, and best practices. This will ensure that the finance department remains agile, responsive, and wellequipped to navigate the ever-changing financial environment.

Conclusion

Optimizing your finance department is an ongoing process that requires commitment, strategic planning, and investment. By implementing these strategies, your organization can streamline its financial operations, improve efficiency, and ultimately enhance its overall financial performance. Start today by evaluating your finance department’s current processes and identifying areas for improvement to pave the way for a more

efficient and effective financial management system. Remember, a well-optimized finance department not only contributes to the organization’s success but also serves as a valuable strategic partner in driving sustainable growth and profitability

Robotic Process Automation

Blog Categories

Feel free to get in touch with our experts.

Other articles

Emerging Chatbot Trends: AI Technology, NLP, Sentiment Analysis & Multi-Language Support for Customer Support

Enhancing healthcare through intelligent conversation. Enhancing Mental Health Support and...

Read MoreHow to Get Started with AI and RPA

Introduction to AI and RPA: A Beginner’s Guide Artificial Intelligence...

Read MoreAI and RPA for Customer Service

The Impact of AI and RPA on Customer Service: Enhancing...

Read More