Integrating financial management software with invoicing and expense management systems can have a profound impact on a company’s financial visibility and control. By combining these essential tools, businesses can streamline their financial processes, gain real-time insights into their financial health, and enhance their overall efficiency. In this article, we will explore the benefits of integrating financial management software with invoicing and expense management systems and how it can revolutionize the way businesses manage their finances.

Having a clear understanding of your company’s financials is crucial for making informed business decisions. The integration of financial management software with invoicing and expense management systems allows for seamless data flow and synchronization across different departments. This integration empowers businesses to have a holistic view of their finances, with real-time updates on invoices, expenses, and cash flow. It eliminates the need for manual data entry and reduces the risk of errors, ensuring accurate financial reporting.

Moreover, this integration provides businesses with better control over their finances. With instant access to financial data, businesses can monitor their cash flow, track expenses, and identify potential areas of improvement. They can generate detailed financial reports and analyze key performance indicators to make data-driven decisions. By automating financial processes and reducing manual work, businesses can save time and resources, allowing their finance teams to focus on strategic initiatives.

In conclusion, integrating financial management software with invoicing and expense management systems can bring about a significant positive impact on a company’s financial visibility and control. By harnessing the power of these integrated tools, businesses can optimize their financial processes, gain valuable insights, and improve their overall financial management. Embracing this integration is a step towards greater efficiency and success in today’s fast-paced business landscape.

Financial management software integration with invoicing and expense management systems has a significant impact on improving financial visibility and control. By integrating these systems, businesses can gain real-time insights into their financial data, allowing for better decision-making and resource allocation. The integration streamlines processes, reduces manual errors, and enhances efficiency. With improved visibility, businesses can closely monitor their cash flow, track expenses, and manage invoices more effectively. This integration ultimately leads to better financial control, increased accuracy, and improved overall financial performance.

The Impact of Integrating Financial Management Software with Invoicing and Expense Management Systems for Improved Financial Visibility and Control

Financial management plays a crucial role in the success of any business. It involves effective management of income, expenses, and investments to ensure financial stability and growth. In today’s digital age, businesses have access to a wide range of software solutions that can streamline financial processes and improve overall financial visibility and control. One such solution is integrating financial management software with invoicing and expense management systems. This integration can have a significant impact on businesses, helping them achieve better financial visibility and control.

Enhanced Financial Visibility

By integrating financial management software with invoicing and expense management systems, businesses can achieve enhanced financial visibility. These systems provide real-time data and analytics, allowing businesses to track their financial performance accurately. With access to up-to-date financial information, businesses can make informed decisions and take proactive steps to optimize their financial health. They can identify trends, spot potential issues, and make necessary adjustments to ensure financial stability.

Moreover, integrated systems offer comprehensive reporting capabilities, enabling businesses to generate detailed financial reports effortlessly. These reports provide a holistic view of the organization’s financial position, including revenue, expenses, cash flow, and profitability. This enhanced visibility empowers businesses to identify areas for improvement, optimize processes, and make data-driven financial decisions.

Streamlined Invoicing Processes

Integrating financial management software with invoicing systems streamlines the invoicing process, leading to improved efficiency and accuracy. Manual invoicing can be time-consuming and prone to errors, resulting in delayed payments and financial discrepancies. However, with an integrated system, businesses can automate the entire invoicing process, from creating and sending invoices to tracking payment status.

Automated invoicing systems ensure that invoices are generated promptly and accurately, reducing the risk of errors. Businesses can customize invoice templates, add branding elements, and include detailed information about products or services. Additionally, integrated systems can automatically calculate taxes, apply discounts, and send reminders for overdue payments. This automation not only saves time but also improves cash flow and reduces the risk of financial discrepancies.

In addition to streamlining the invoicing process, integrated systems also provide businesses with valuable insights into their invoicing performance. They can track invoice statuses, monitor payment trends, and identify late-paying customers. This information allows businesses to take appropriate actions to improve cash flow, such as implementing stricter payment terms or offering early payment incentives.

Improved Expense Management

Effective expense management is crucial for maintaining financial control and optimizing profitability. By integrating financial management software with expense management systems, businesses can streamline their expense tracking and management processes.

Integrated systems allow businesses to automate expense recording, eliminating the need for manual data entry. Employees can easily submit expense reports, attach receipts, and categorize expenses using predefined categories. Automated expense management systems can also integrate with corporate credit cards and bank accounts, automatically importing transaction data and matching them with corresponding expenses. This automation saves time and reduces the risk of human error in expense tracking.

Furthermore, integrated systems offer robust expense analytics and reporting features. Businesses can generate expense reports that provide insights into spending patterns, identify areas of overspending, and track compliance with expense policies. This visibility into expenses enables businesses to make informed decisions about cost-cutting measures, negotiate better vendor contracts, and identify opportunities for process optimization.

Optimized Financial Control

The integration of financial management software with invoicing and expense management systems also enhances financial control for businesses. With real-time data and automated processes, businesses can establish greater control over their financial operations.

Integrated systems provide businesses with centralized control and visibility over their financial processes. Invoices, expenses, and payments can be tracked and managed from a single platform, eliminating the need for manual reconciliation and reducing the risk of errors and fraud. Businesses can set up approval workflows, ensuring that all financial transactions go through the appropriate channels. This control minimizes the risk of unauthorized spending and ensures compliance with financial policies and regulations.

Moreover, integrated systems offer robust security measures to protect sensitive financial data. Encryption, user access controls, and audit trails help safeguard financial information and prevent unauthorized access. This enhanced security provides businesses with peace of mind and ensures the integrity and confidentiality of their financial data.

In conclusion, integrating financial management software with invoicing and expense management systems can have a significant impact on businesses’ financial visibility and control. It enhances financial visibility by providing real-time data and comprehensive reporting capabilities. The integration streamlines invoicing processes, improving efficiency and accuracy. It also optimizes expense management, enabling businesses to track expenses, identify spending patterns, and make informed financial decisions. Overall, the integration of these systems enhances financial control and helps businesses achieve improved financial stability and growth.

The Impact of Integrating Financial Management Software with Invoicing and Expense Management Systems

- Integrating financial management software with invoicing and expense management systems allows businesses to have a clear view of their financial situation.

- By automating the invoicing and expense management processes, businesses can save time and reduce the risk of errors.

- Improved financial visibility enables businesses to monitor cash flow, track expenses, and make informed financial decisions.

- Integrating these systems also enhances control over financial operations, ensuring compliance with regulations and internal policies.

- With better financial visibility and control, businesses can optimize their financial performance and achieve their goals more effectively.

Frequently Asked Questions

1. How does integrating financial management software with invoicing and expense management systems improve financial visibility?

Integrating financial management software with invoicing and expense management systems provides a comprehensive view of an organization’s financials. By automating the tracking and recording of financial data, businesses gain real-time insights into their cash flow, revenue, and expenses. This enhanced visibility allows for better financial planning and decision-making, as it enables businesses to identify areas of financial strength or weakness and take appropriate actions.

Moreover, integrating these systems eliminates the need for manual data entry and reconciliation, reducing the risk of errors and ensuring accuracy in financial reporting. With all financial information consolidated in one platform, businesses can easily generate reports, analyze trends, and make informed financial decisions.

2. What impact does integrating financial management software have on expense management?

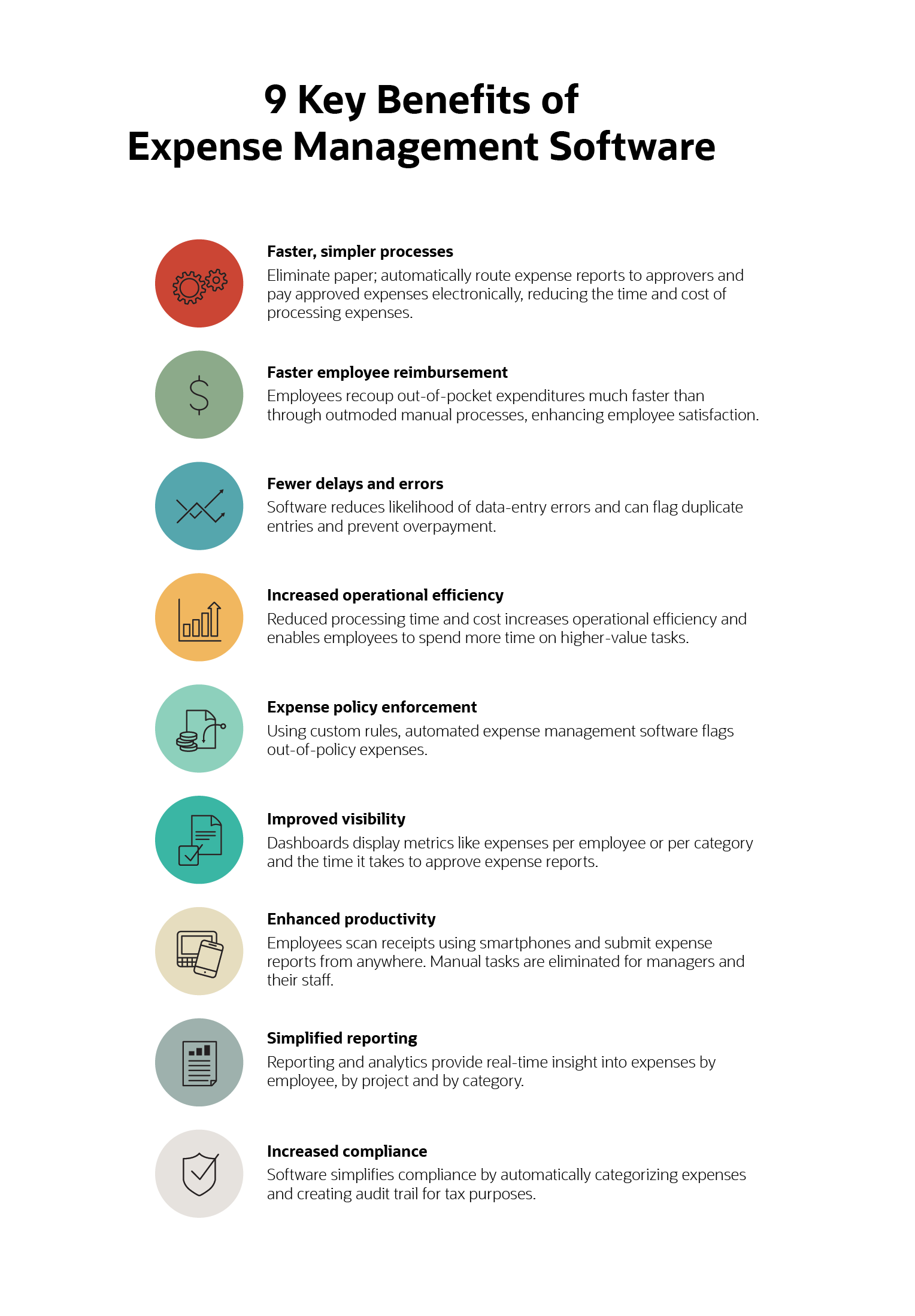

Integrating financial management software with expense management systems simplifies and streamlines the entire expense management process. By automating expense tracking and reimbursement workflows, businesses can reduce administrative overhead and ensure timely and accurate expense reporting.

With integrated systems, employees can easily submit expenses using digital tools, such as mobile apps, and managers can review and approve expenses in a centralized platform. This not only improves efficiency but also enhances financial control by enforcing policy compliance and preventing fraudulent or unauthorized expenses. Additionally, integrated systems provide real-time visibility into expenses, allowing businesses to identify cost-saving opportunities and optimize their spending.

3. How does integrating financial management software with invoicing systems enhance financial control?

Integrating financial management software with invoicing systems improves financial control by streamlining the invoicing process and ensuring accuracy and timeliness in billing. Through automation, businesses can generate invoices based on predefined templates and send them directly to customers, reducing manual effort and minimizing the risk of errors.

Furthermore, integrated systems enable businesses to track and monitor outstanding invoices, send reminders for overdue payments, and reconcile payments received. This enhanced visibility and control over the invoicing process allow businesses to optimize cash flow, reduce payment delays, and improve overall financial performance.

4. What are the benefits of integrating financial management software with invoicing and expense management systems?

Integrating financial management software with invoicing and expense management systems offers numerous benefits for businesses. Firstly, it improves financial visibility by providing real-time insights into cash flow, revenue, and expenses. This enables businesses to make informed decisions, identify financial trends, and plan effectively for the future.

Secondly, integrated systems streamline financial processes, reducing manual effort and the risk of errors. This leads to increased efficiency, cost savings, and improved productivity. Additionally, integrating these systems enhances financial control by enforcing policy compliance, preventing fraud, and optimizing cash flow management.

5. How can integrating financial management software impact overall financial performance?

Integrating financial management software with invoicing and expense management systems can have a significant positive impact on overall financial performance. By providing real-time visibility into financial data, businesses gain insights that enable them to optimize revenue generation and expense management.

Moreover, the automation of financial processes minimizes administrative overhead and reduces the risk of errors, resulting in cost savings and improved efficiency. With accurate and timely financial information, businesses can make informed decisions, identify areas for improvement, and implement strategies to enhance profitability and financial stability.

Conclusion

In the ever-evolving world of finance, harnessing the power of technology is crucial to staying ahead. The integration of financial management software with invoicing and expense management systems has proven to be a game-changer, offering businesses improved financial visibility and control. The impact of this integration cannot be overstated, as it empowers organizations to streamline their financial processes, make data-driven decisions, and optimize their overall financial health.

By integrating financial management software with invoicing and expense management systems, businesses can say goodbye to manual data entry and tedious reconciliation processes. This seamless integration allows for the automatic transfer of data, ensuring accuracy and reducing the risk of human error. With real-time updates and consolidated financial information at their fingertips, organizations can gain a comprehensive view of their financial status, enabling them to make informed decisions and drive growth.

Moreover, the integration of these systems enhances financial control by providing a centralized platform for monitoring and managing expenses. With the ability to track and categorize expenses, businesses can identify cost-saving opportunities and implement effective budgeting strategies. This level of control not only improves financial stability but also enables organizations to allocate resources efficiently and optimize their cash flow.

In conclusion, the integration of financial management software with invoicing and expense management systems is a transformative step toward improved financial visibility and control. By embracing this integration, businesses can automate their financial processes, gain real-time insights, and make data-driven decisions that propel them toward success. So, why settle for the complexities of manual financial management when integration can unlock a world of efficiency and growth? Embrace the power of integration and take your financial management to new heights.