In today’s rapidly evolving financial landscape, businesses are constantly seeking ways to streamline their operations and maximize efficiency. One powerful solution that has emerged is the integration of Robotic Process Automation (RPA) and Artificial Intelligence (AI) in financial analysis. By harnessing the power of automation and advanced algorithms, companies are driving productivity and achieving significant cost savings. In this article, we will explore the transformative impact of RPA and AI in financial analysis and how they are revolutionizing the way organizations analyze and interpret financial data.

The marriage of RPA and AI in financial analysis is a game-changer, enabling businesses to automate repetitive tasks and leverage intelligent algorithms to extract valuable insights from vast amounts of data. With RPA, mundane and time-consuming processes such as data entry, reconciliation, and report generation can be automated, freeing up valuable time for finance professionals to focus on more strategic initiatives. AI, on the other hand, empowers businesses to uncover patterns, trends, and anomalies in financial data that would be nearly impossible for humans to detect. By combining these two technologies, organizations can achieve unprecedented levels of productivity and efficiency in their financial analysis workflows.

As the demand for real-time and accurate financial insights grows, RPA and AI are becoming essential tools for financial institutions, accounting firms, and businesses across industries. The ability to automate tasks, reduce errors, and gain deeper insights into financial data not only drives productivity but also leads to substantial cost savings. With RPA and AI, businesses can eliminate manual errors, reduce the need for human intervention, and ultimately achieve greater accuracy and efficiency in their financial analysis processes. In the following sections, we will delve deeper into the specific benefits and applications of RPA and AI in financial analysis, highlighting real-world examples and success stories. Stay tuned to discover how these technologies are reshaping the financial landscape and propelling organizations towards a more prosperous future.

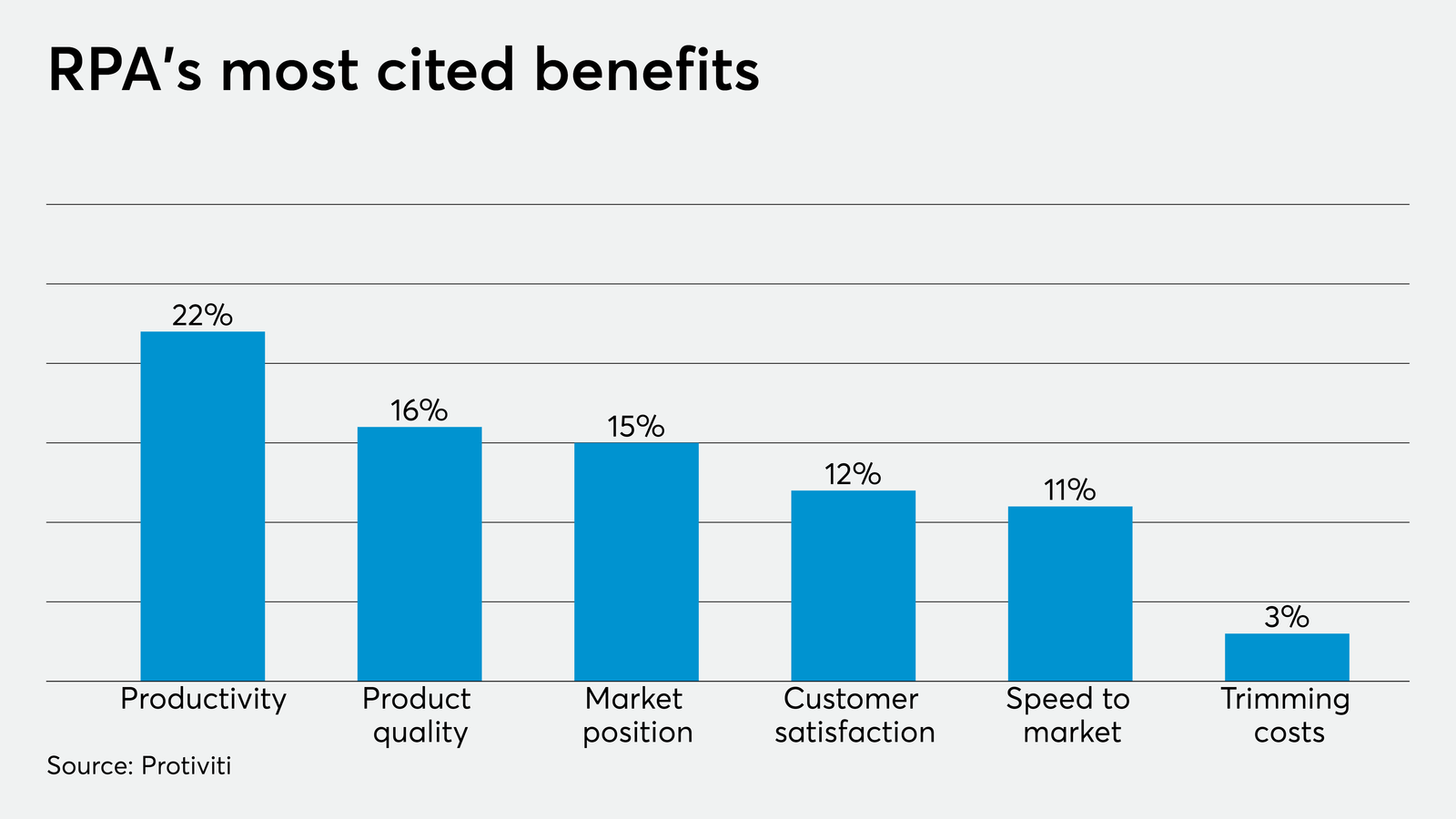

RPA and AI are revolutionizing financial analysis, driving productivity and savings for businesses. By automating repetitive tasks and leveraging advanced algorithms, these technologies enable faster and more accurate data analysis, allowing financial professionals to make informed decisions quickly. RPA streamlines processes such as data entry and reconciliation, reducing errors and saving valuable time. AI-powered algorithms can analyze vast amounts of financial data, uncovering insights and patterns that humans may miss. Together, RPA and AI enhance efficiency and effectiveness in financial analysis, leading to increased productivity and cost savings.

RPA and AI in Financial Analysis: Driving Productivity and Savings

Financial analysis plays a crucial role in decision-making for businesses and individuals alike. It involves evaluating financial data to assess the performance and profitability of an organization. Traditionally, financial analysis has been a labor-intensive process, requiring considerable time and effort to analyze large volumes of data. However, with the advent of Robotic Process Automation (RPA) and Artificial Intelligence (AI), financial analysis has become more efficient and cost-effective, driving productivity and savings for businesses.

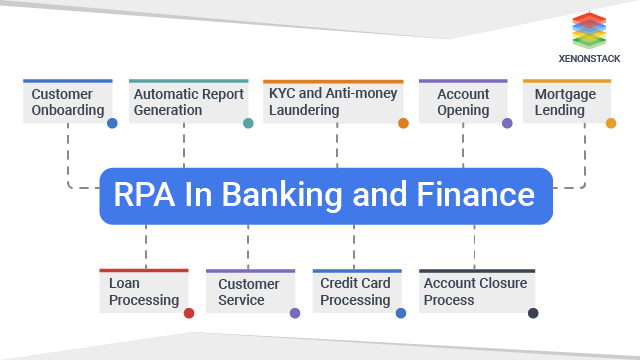

RPA and AI have revolutionized financial analysis by automating repetitive tasks and enhancing data analysis capabilities. RPA refers to the use of software robots or bots to automate manual and rule-based processes. These bots can perform tasks such as data entry, data reconciliation, and report generation, eliminating the need for human intervention. On the other hand, AI involves the use of algorithms and machine learning techniques to analyze and interpret financial data, providing valuable insights and predictions.

One of the key benefits of RPA and AI in financial analysis is increased efficiency. By automating repetitive tasks, organizations can save significant time and resources. For example, bots can extract financial data from multiple sources, collate it, and generate reports in a matter of minutes, a task that would typically take hours or even days for a human analyst. This efficiency not only saves time but also enables organizations to make faster and more informed decisions.

In addition to time savings, RPA and AI in financial analysis also drive cost savings. By automating manual processes, organizations can reduce the need for human resources, thereby cutting labor costs. Moreover, AI algorithms can analyze large volumes of financial data more accurately and quickly than humans, reducing the risk of errors and costly mistakes. These cost savings can be significant for businesses, especially those operating on tight budgets or in highly competitive industries.

Another advantage of RPA and AI in financial analysis is improved accuracy and reliability. Human analysts are prone to errors, especially when dealing with complex data sets or performing repetitive tasks. RPA bots, on the other hand, can consistently and accurately perform calculations, ensuring reliable results. AI algorithms can also detect patterns and trends in financial data that may go unnoticed by human analysts, providing valuable insights for decision-making.

RPA and AI in financial analysis also enable real-time monitoring and reporting. With the ability to extract and analyze data in real-time, organizations can stay updated on their financial performance and make timely adjustments as needed. This real-time monitoring allows businesses to identify potential risks or opportunities quickly and take appropriate action. It also enhances transparency and accountability, as financial information is readily available and accessible to stakeholders.

Furthermore, RPA and AI can assist in fraud detection and prevention in financial analysis. By analyzing financial data from various sources, AI algorithms can identify anomalies or suspicious patterns that may indicate fraudulent activities. This proactive approach to fraud detection can save organizations from significant financial losses and reputational damage.

In conclusion, RPA and AI have revolutionized financial analysis by driving productivity and savings for businesses. With their ability to automate manual tasks, enhance data analysis capabilities, and provide real-time insights, RPA and AI enable organizations to make faster, more informed decisions. The increased efficiency, cost savings, improved accuracy, and fraud detection capabilities offered by RPA and AI make them invaluable tools in today’s financial landscape. As businesses continue to embrace digital transformation, the adoption of RPA and AI in financial analysis will become increasingly prevalent, shaping the future of financial decision-making.

Key Takeaways: RPA and AI in Financial Analysis: Driving Productivity and Savings

- RPA and AI are technologies that can automate financial analysis processes.

- By using RPA and AI, businesses can increase productivity and save time.

- These technologies can perform tasks such as data collection, analysis, and reporting.

- Financial analysis with RPA and AI can identify trends and patterns in large datasets.

- Implementing RPA and AI in financial analysis can lead to cost savings and improved accuracy.

Frequently Asked Questions

What is the role of RPA and AI in financial analysis?

RPA (Robotic Process Automation) and AI (Artificial Intelligence) have revolutionized financial analysis by automating repetitive tasks, reducing manual errors, and providing valuable insights. RPA software robots can perform tasks like data entry, reconciliation, and report generation with speed and accuracy. AI algorithms can analyze large volumes of financial data, detect patterns, and make predictions, enabling financial analysts to make informed decisions.

By leveraging RPA and AI in financial analysis, organizations can drive productivity by freeing up analysts’ time from mundane tasks and allowing them to focus on strategic analysis. These technologies also enable faster processing of financial data, leading to quicker decision-making and improved efficiency.

How can RPA and AI drive productivity in financial analysis?

RPA and AI can drive productivity in financial analysis by automating time-consuming and repetitive tasks. RPA software robots can be programmed to perform tasks such as data extraction, data entry, and report generation, which would otherwise require manual effort. This automation reduces the time spent on these tasks and allows financial analysts to focus on higher-value activities.

AI algorithms can analyze vast amounts of financial data and generate insights at a much faster pace than humans. By leveraging AI, financial analysts can quickly identify trends, patterns, and anomalies in the data, enabling them to make more accurate and timely decisions. This speed and efficiency ultimately lead to increased productivity in financial analysis.

How can RPA and AI contribute to savings in financial analysis?

RPA and AI can contribute to savings in financial analysis by reducing the need for manual labor and minimizing errors. RPA software robots can perform tasks that were previously done manually, eliminating the need for additional human resources. This reduces labor costs and increases operational efficiency.

Furthermore, AI algorithms can detect anomalies and potential risks in financial data, helping organizations prevent fraud and identify cost-saving opportunities. By leveraging AI-powered predictive analytics, financial analysts can make data-driven decisions that optimize resource allocation, reduce expenses, and maximize savings.

What are the benefits of using RPA and AI in financial analysis?

Using RPA and AI in financial analysis offers several benefits. Firstly, it improves accuracy by reducing human errors associated with manual data entry and analysis. RPA software robots perform tasks with precision and consistency, ensuring reliable financial analysis.

Secondly, it enhances efficiency by automating repetitive tasks, allowing financial analysts to focus on more strategic activities. RPA and AI also enable faster data processing and analysis, enabling timely decision-making and improving overall operational efficiency.

Lastly, RPA and AI provide valuable insights through advanced data analysis, enabling financial analysts to make informed decisions and identify opportunities for cost savings and revenue growth. These technologies empower organizations to stay competitive in the rapidly evolving financial landscape.

What are the potential challenges of implementing RPA and AI in financial analysis?

While RPA and AI offer numerous benefits in financial analysis, there are also potential challenges to consider. One challenge is the need for specialized skills and expertise to implement and maintain these technologies. Organizations may need to invest in training or hiring professionals with knowledge of RPA and AI.

Data security and privacy are also crucial considerations when implementing RPA and AI in financial analysis. Organizations must ensure that sensitive financial data is protected and compliant with applicable regulations.

Another challenge is the resistance to change from employees who may be apprehensive about the automation of their tasks. Effective change management strategies and clear communication are essential to address these concerns and gain employee buy-in.

Final Summary: RPA and AI in Financial Analysis – Unlocking Efficiency and Cost Savings

As we reach the end of this exploration into the world of RPA and AI in financial analysis, it’s clear that these technologies have a transformative impact on productivity and cost savings. By automating repetitive tasks, reducing errors, and providing accurate insights, RPA and AI enable financial professionals to focus on higher-value activities and make informed decisions.

The integration of RPA and AI in financial analysis not only streamlines processes but also enhances accuracy and efficiency. With the ability to analyze vast amounts of data in real-time, these technologies uncover valuable patterns and trends that humans may overlook. This empowers financial institutions to identify risks, optimize operations, and drive growth. Moreover, the cost savings achieved through automation and improved accuracy can significantly impact the bottom line, allowing organizations to allocate resources strategically and invest in future growth.

In conclusion, the synergy between RPA and AI in financial analysis is a game-changer. By harnessing the power of automation and intelligent data analysis, organizations can unlock productivity, drive cost savings, and gain a competitive edge in the dynamic financial landscape. As these technologies continue to evolve and become more sophisticated, the opportunities for innovation and efficiency in the financial sector are boundless. It’s time for financial professionals to embrace the possibilities and leverage RPA and AI to propel their organizations forward into a future of enhanced productivity and sustainable growth.